Venmo, Apple Pay and Paypal are just a few of the online payment platforms that have risen in popularity the last few years. Seemingly flawless, users create an account, upload some basic banking information and just like that they can send money with the click of a button. Some apps, such as Apple Pay, can even be used to make in-store purchases, supposedly eliminating the need for cash, or to even carry a credit card.

But, with almost any new technology innovation, there are risks. So, how do we take advantage of these advancements while protecting ourselves?

Start by checking your account settings. Although a quick set-up process is super convenient, for an app that is connected to your bank account and/or credit cards, it’s worth taking a deeper look into what you’ve selected.

Note: one exception would be Apple Pay. Apple Pay doesn’t have the social media aspect that the other apps have so there aren’t specific settings to check, though it’s important to remain vigilant since payments can be sent and received via text messages.

Venmo

Venmo has a few different options when it comes to sharing your transaction history. “Public” allows for anybody on the app to see when and who you’ve paid, and the reason you gave. “Friends Only” allows for all of your friends on the app to see that information, the recipient and the recipient’s friends. “Private” hides all of your transactions, so only you and the recipient are able to see them.

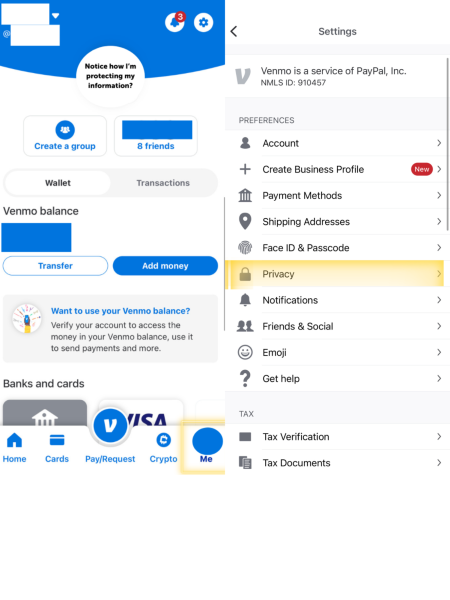

To check your account settings on Venmo, start by clicking on “Me” in the bottom right hand corner. Next, hit the settings button (a small gear) in the upper right hand corner. From there, hit the “Privacy” button (a small lock). This will now allow you to see the privacy setting you previously selected.

Paypal

The Paypal app doesn’t have quite as much of a social media feel as Venmo does, but there are still some privacy settings that are important to take a look at.

While Paypal doesn’t have the option for a private account, what you can control is who and how people can find you.

Only one button in Paypal’s settings controls whether or not any person with the app can search your name, username, email or cell phone number to find your profile. And, with that setting on, they can hit just one more button and see the city and state you live in.

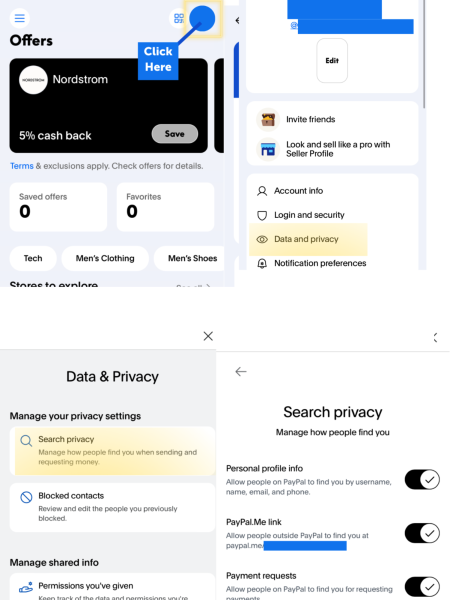

A safer option? You can make your profile searchable by “Contacts Only” meaning only the people in your contacts are able to find your account, or you can turn off “Paypal.Me link” which will prevent people without the Paypal app from finding your profile. Another option is turning off “Payment Requests” which will prevent people from being able to find your account to request money. For those of you dodging some debt, this is certainly a valuable option. Even more protective, you can turn “Personal Profile Info” off all together, meaning people can only find you via your personalized QR code.

So, how do we find this?

First, from the home screen, click on your profile picture in the top right corner. Next, select “Data and Privacy,” then “Search Privacy.” From there, you have several options ranging in privacy levels, depending on what exactly you are using the app for.

Remaining Vigilant

As we drift further away from cash and physical credit cards, staying on top of our privacy and security settings is more important now than ever. As quick and easy as an account is to make, take the time to read exactly what buttons you’re clicking and what terms you are accepting. Also, don’t forget to reach out to your local bank branch as they may have safer company specific options or recommendations.