Inflation: A Case Study

June 1, 2022

INFLATION- a concept, and more than a buzzword. It’s been rising at a dramatic rate for the past few months, with the U.S. CPI (Consumer Price Index) rising by over 8% through April. In short, prices are that much higher now than they were at this time last year.

It’s not just happening in America. In Europe, inflation is rising at similar rates in several developed economies. France, Germany, and the U.K. are reporting similar CPI increases, with the Euro suffering from inflation not seen since 1999 (when it was created).

As is customary with spikes in inflation, several economic issues have either been created or made more severe. Supply-chain issues have disrupted global markets, with goods that are highly demanded failing to reach enough consumers to begin with. Rising prices mean that people are burning through their savings at an alarming rate, which may not bode well with any future downturns. Gas prices are reaching record levels. Consumer confidence has plummeted.

All the while, the financial world nervously awaits the Government’s next step— or misstep— depending on who you ask. To kick things off, Treasury Secretary Janet Yellen recently said she was “wrong” about “the path that inflation would take” when she downplayed inflation as an issue back in 2021. The Federal Reserve, under Chairman Jerome Powell, has raised interest rates while consistently sending mixed signals about how severe things would get.

It’s hard to simplify inflation as an issue, due to it occurring for a myriad of reasons and subsequently causing a myriad of issues. However, given current events, we can take a few guesses.

One reason is simple: the COVID-19 Pandemic. More specifically, the stimulus money printed by multiple governments and spending habits in its aftermath (hopefully the worst of it anyway).

In May of 2020, once it became clear the Coronavirus wouldn’t miraculously go away in April, the Trump Administration immediately began printing stimulus checks to alleviate the financial blow on people and, more importantly, large corporations. The Biden Administration continued stimulus spending in this regard with the $1.9 trillion dollar American Rescue Plan. Checks? Child Tax Credit? Thank the stimulus bills. It was great while it lasted. Fast forward to the present day, and these actions have harmed the money supply and caused record-breaking inflation.

Were stimulus payments at least partially justified, even the package in 2021? With the amount of economic hardship caused by the pandemic, absolutely. Was it a bad idea to not target them more efficiently? Definitely— there wasn’t any good reason not to beyond gaining political clout. There are a number of conclusions that can be drawn here. The bottom line here is that the relatively uncharacteristic amount of money distributed by the government did contribute to inflation.

When there is more money on the market, sellers will raise their prices to keep up. Given the amount of consumer spending taking place in spite of this, the future is uncertain at best.

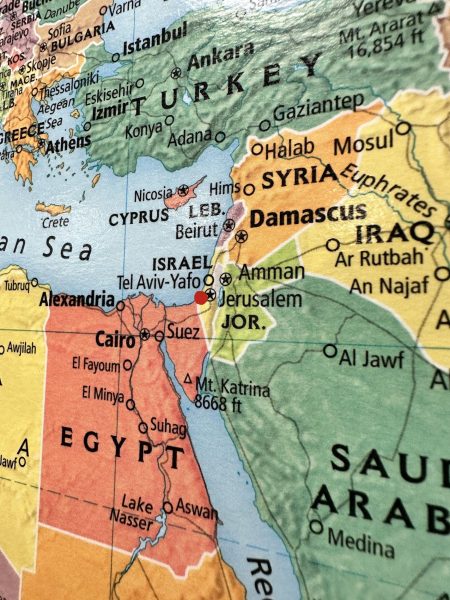

A newer cause of inflation would be the ongoing war in Ukraine. This especially explains why Europe’s CPI has begun to mirror the U.S. CPI. Once known as the

“Breadbasket of Europe,” Ukraine has been under assault from Russia since February. Due to Russia seizing most of the Black Sea coastline and blockading areas still under Ukrainian control, along with their concentrated and brutal land attack in the Donbas region, grain and wheat exports from a region that normally accounts for a third of them have plummeted.

Understandably, wheat and grain prices have skyrocketed. Furthermore, Russia is a major exporter of oil and natural gas. Sanctions on its economy imposed by the U.S, Europe and other allied nations have contributed, in part, to rising gas prices. All things considered, the economic turmoil plaguing a world attempting to reopen itself, along with war in Europe, has likely created much of the downturn experienced today.

Inflation has gotten pretty bad in the past, with record numbers in the mid to late 20th century due to mass spending after World War II. Recessions that occured in the 70s’ and 80s’ were brutal for everyone in the short run, but they were eventually fixed through revising some form of fiscal or monetary policy. Today’s inflation has some similarities, with a fair amount of mistakes made along the way by government officials. However, how much blame should any one side receive for this (apart from Russia, which has single handedly made things worse)? There isn’t an easy answer.